© 2025 complexitytrading.ai All rights reserved.

Scale Convergence Overlay, (SCO) - What It Is (And Isn’t)

Forget signals. Forget crosses. Forget the illusion of confirmation.

SCO isn’t here to tell you when to buy or sell. It doesn’t claim to predict direction or spot “trends.” It doesn’t know your strategy, your bias, or your timeframe.

Instead, it measures how aligned the system is. How confident it feels — or how fractured.

It tells you when the market is humming in sync across structural layers — and when it’s not.

SCO doesn’t care about your favorite candlestick pattern. It doesn’t know MACD, RSI, or Bollinger Bands.

It listens to the underlying current — and shows you whether different time scales are agreeing or arguing.

That agreement? That’s what we call confluence.

And confluence is where the structural signal becomes more coherent.

SCO is…

⦁ A structural consensus detector

⦁ A slope interpreter across time tiers

⦁ A framework for detecting systemic alignment

⦁ A contextual amplifier when used with LPPLCP, TPM, and Coreline

⦁ A state monitor, not a prediction engine

⦁ Most useful when several timeframes flip together

SCO isn’t…

⦁ A trade signal generator

⦁ A momentum oscillator

⦁ A trend confirmation tool

⦁ A volatility filter

⦁ An entry/exit system by itself

⦁ A predictor of price outcomes

What It Actually Tells You

SCO expresses how much agreement exists across a set of structural timeframes — Micro, Meso, and Macro.

It tracks whether the directional slope of the system is gaining coherence or falling into noise.

You can think of it like market gravity:

⦁ When slopes across tiers point in the same direction → gravity increases.

⦁ When they diverge → gravity weakens.

Strong gravity = high odds of a decisive move.

Weak gravity = drift, chop, or whipsaw.

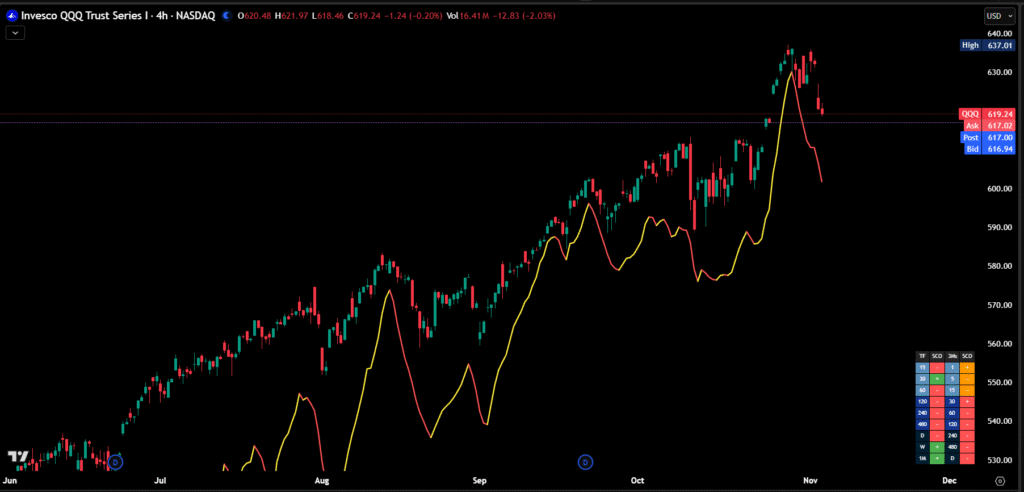

SCO Line Overlay on QQQ (4h)

This chart illustrates the behavior of the Scale Convergence Overlay (SCO) line plotted over price, highlighting moments of structural agreement (yellow) and divergence (red). This example is provided to demonstrate the tool’s alignment behavior across timeframes. It is not a recommendation or predictive indicator

Because SCO is a structural alignment tool, its real power emerges when used in conjunction with other Complexity Trading modules.

⦁ LPPLCP Pulse / Static

Use to detect background compression or instability. SCO flips carry more weight when Pulse is active or Static shows regime tension.

⦁ TPM (Temporal Phase Model)

Where TPM reveals the where of structural pull, SCO reveals the when. Used together, they map both gravity and timing:

⦁ TPM marks attractors, the places price may be drawn.

⦁ SCO marks convergence, the moment behavior begins to align with intent.

They are structural reads, one showing the field, the other showing the shift.

⦁ PILL

SCO is early … even twitchy but that’s because its quick to pick up on structural tremors moments of tension, alignment, or drift that precede visible movement. Pill confirms the momentum detected by SCO and acts as a confirmation there has been a shift from preparation to action. Together:

⦁ SCO + Pill = Greater visibility into timing and behavior

⦁ SCO can help identify structural alignment early

⦁ Pill may help validate when that shift begins to carry momentum

⦁ Together, they provide the structure. You decide the strategy

⦁ SIDE

When SCO starts getting twitchy, it looks to SIDE for confirmation. If SIDE’s still aligned, the structure holds steady; if not, the tremor might be real

Confluence is the key.

SCO shows when structure is changing. LPPLCP shows why it’s happening. TPM shows where it wants to go. PILL helps with how to trade it.

Disclaimer!: For educational purposes only. Not investment or trading advice. No representation of accuracy or completeness; no guarantees. Trading involves risk, and past performance is not indicative of future results. You are solely responsible for your own decisions.

Charts, tools, and indicators utilized on this site are primarily provided by TradingView®. TradingView® is a registered trademark of TradingView, Inc., and holds no affiliation with the website owner, developers, or providers described herein.