© 2025 complexitytrading.ai All rights reserved.

SIDE — What It Is (And Isn’t)

Forget signal overload. Forget reactive indicators. Forget interpreting noise as intent.

SIDE doesn’t forecast price or predict outcomes. It doesn’t generate buy or sell signals. It doesn’t know your objectives, your strategy, or your position in the market.

What it does is measure internal system agreement.

SIDE observes two structurally distinct models, each interpreting the market through different lenses. When both independently arrive at a directional consensus and meet internal stability thresholds, SIDE outputs a synchronized event.

That output isn’t a recommendation. It’s a readout:

A rare moment when two systems align on directional behavior, without contradiction.

SIDE doesn’t react to every move. It filters for structural coherence and only responds when its internal conditions are met.

It’s not about prediction. It’s about detecting internal consistency across models and surfacing that condition when it occurs.

SIDE is...

• A dual-system agreement detector

• A filter for internal model alignment

• A state-based output engine

• An expression of systemic coherence

• Most useful when read in context with other structural tools

SIDE isn’t...

• A trade signal generator

• A trend prediction tool

• A directional bias confirmation model

• A momentum indicator

• An entry/exit recommendation system

What It Actually Tells You

SIDE tracks whether two independent analytical models, each with its own structure, assumptions, and logic, are currently in directional agreement. When both models align and meet strength conditions, SIDE outputs a visual marker.

This alignment is not a forecast or an instruction. It is a system state: a snapshot of internal consensus .

You can think of it like this:

• If the models agree → SIDE expresses that alignment

• If they disagree → SIDE remains silent

• If the agreement lacks strength → no output is shown

Used on its own, SIDE offers insight into systemic consistency.

Used with broader tools like SCO, TPM, PILL, or LPPLCP, it provides additional context for structural evaluation.

SIDE doesn’t tell you what price will do. It reflects what the system currently agrees upon and when that agreement passes its own internal bar for clarity.

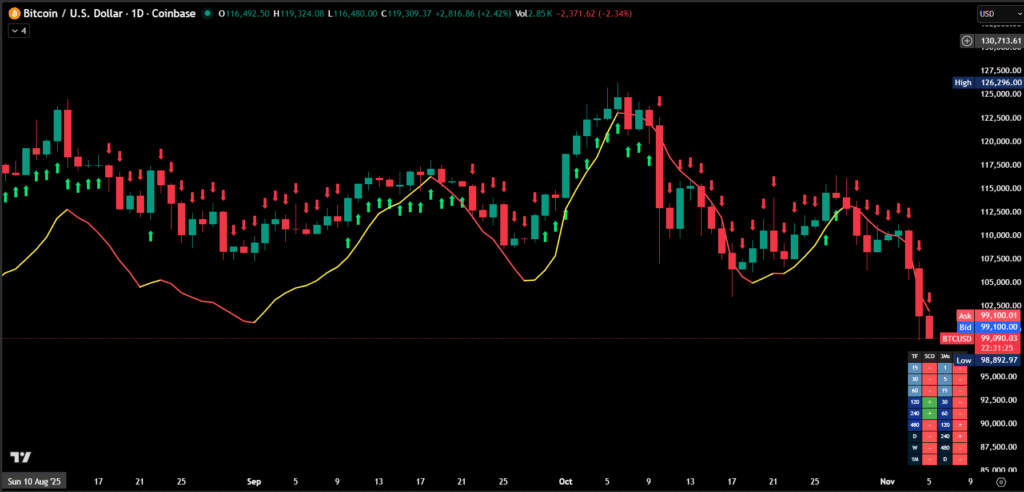

This chart displays structural alignment and internal system agreement:

⦁ Arrows represent moments where two independent estimation models (SIDE) align on directional inference.

⦁ Colored line (SCO) reflects the degree of structural agreement across multiple timeframes.

These tools do not generate trade signals or forecasts. They reflect internal system states and structural conditions for educational and analytical purposes only.

Disclaimer!: For educational purposes only. Not investment or trading advice. No representation of accuracy or completeness; no guarantees. Trading involves risk, and past performance is not indicative of future results. You are solely responsible for your own decisions.

Charts, tools, and indicators utilized on this site are primarily provided by TradingView®. TradingView® is a registered trademark of TradingView, Inc., and holds no affiliation with the website owner, developers, or providers described herein.